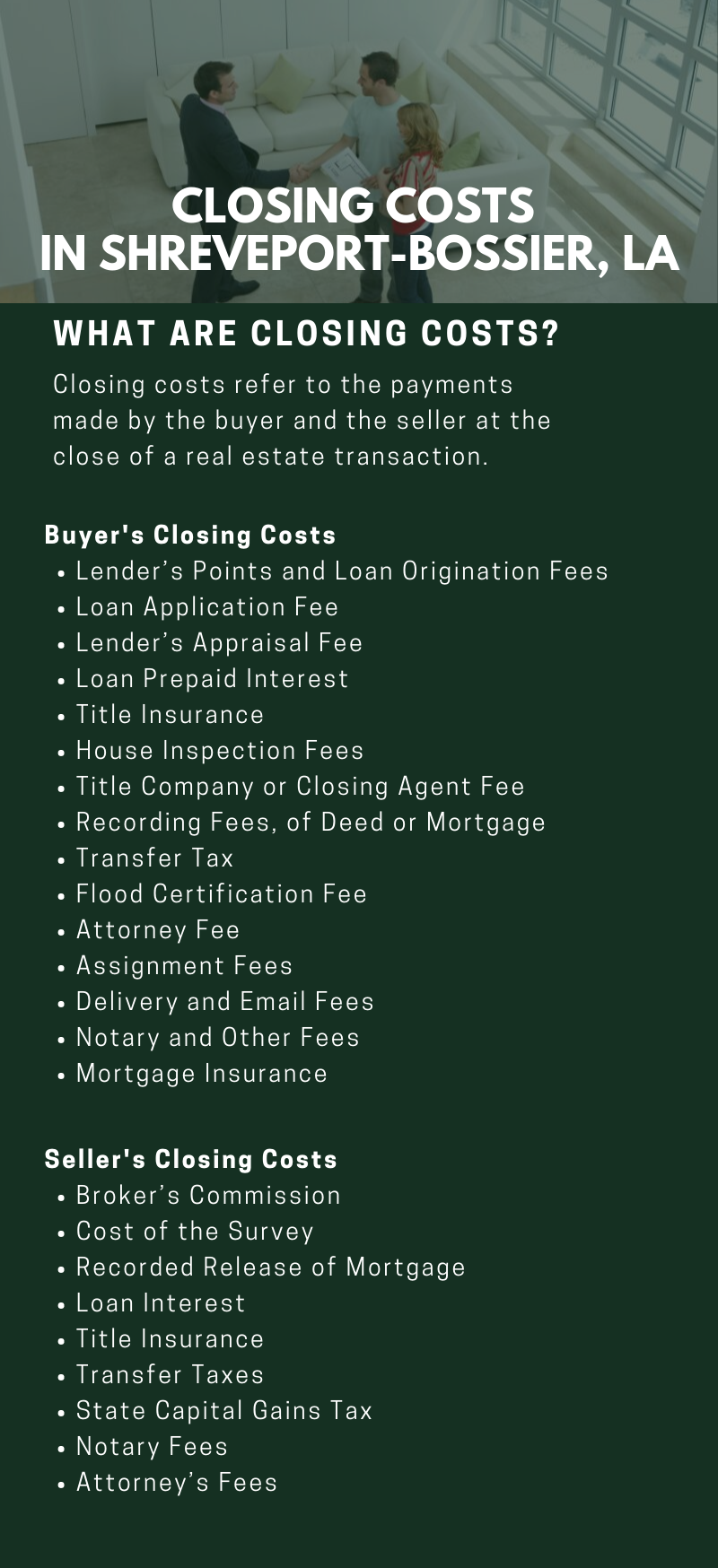

What are Closing Costs?

The final stage of a real estate transaction is called the closing or settlement, and it is during this time when ownership of the property is legally passed on from the seller to the buyer. It is also the time when these parties settle the payment for their respective closing costs – fees for services, taxes or special interest charges that are related to the home purchase. Generally, most closing costs are paid by the buyer, but they may negotiate with the seller to shoulder some of their costs.

Average Closing Costs in Shreveport-Bossier, LA

A homebuyer’s closing costs usually range from 2% to 7% of the home sales price. This is about $2,000 to $7,000 on a $100,000 home purchase in the Shreveport-Bossier, LA area. Lender’s points and loan origination fees cost around 3% of the loan, and lenders may add 1.75% to 3.25% to this rate. Lenders would also charge a loan processing fee, ranging from $200 to $800, and a loan application fee which costs $500 on average. A buyer would have to pay $10 to $100 for each credit report pulled. Lender’s underwriting fee can run between $75 to $600; document preparation fee, $50 to $250; appraisal fee, $225 to $750; and a one-time fee tax escrow service fee, $40 to $125.

The title company or closing agent fee, which is separate from the cost of a title insurance policy, may range from $200 to $1,500 or more, depending on the value of the home being purchased and the value of the mortgage. The cost of the title insurance cost for the lender’s policy ranges between $150 and $1,000, and for the buyer’s policy, $150 to $1,000. Recording fees would be about $25 to $150. House inspection fees would cost anywhere between $250 and $1,000 and flood certification fee ranges from $10 to $50. For attorney fees, the rate generally starts at $500.

For sellers, the highest expense in their closing costs list would be their broker’s fee, which costs around 4% to 7% of the home sale price if the seller is using a full-service brokerage firm and 2% to 3% of the home sale price if the seller is using a discount broker. Notary fees cost $25 on average and the flat fee for attorney’s fees starts at $500.

Breakdown of Closing Costs in Shreveport-Bossier, LA

Typical Closing Costs for Homebuyers

- Lender’s Points and Loan Origination Fees

- Loan Processing Fees

- Loan Application Fee

- Lender’s Credit Report

- Lender’s Underwriting Fee

- Lender’s Document Preparation Fee

- Lender’s Appraisal Fee

- Loan Prepaid Interest

- Lender’s Insurance Escrow

- Lender’s Tax Escrow

- Lender’s Tax Escrow Service Fee

- Title Insurance Cost for the Lender’s Policy

- Title Insurance Cost for the Buyer’s Policy

- Special Endorsements to the Lender’s or Owner’s Title Insurance Policy

- House Inspection Fees

- Title Company or Closing Agent Fee

- Recording Fees, of Deed or Mortgage

- Local City, Town, Or Village Property Transfer Tax

- County Transfer Tax

- State Transfer Tax

- Flood Certification Fee

- Attorney Fee

- Assignment Fees

- Delivery and Email Fees

- Notary and Other Fees

- Mortgage Insurance

- Lender’s Insurance Escrow for Condominium Owners

- Condo Move-In Fee

- Association Transfer Fee

- Co-Op Apartment Fees

- Credit Checks for Condo and Co-Op Buildings by the Board

- Move-In Deposit Fees

Typical Closing Costs for Sellers

- Broker’s Commission

- Broker’s Processing Fee

- Cost of the Survey

- Recorded Release of Mortgage

- Loan Interest

- Lender Fees

- Prepayment Penalties

- Courier Fees

- Title Insurance

- Transfer Taxes

- State Capital Gains Tax

- Notary Fees

- Attorney’s Fees

- FHA Fees and Costs

- Condo/Co-Op Move-Out Fee

- Association Transfer Fees

- Paid Utility Bills

- Certificate of Compliance with Building and Zoning Codes

- Association Reserves

- Special Assessments to Associations

- Home Inspection Fees

- Home Warranty

- Credit to the Buyer of Unpaid Real Estate Taxes

- Other Credits to the Buyer

Upside Down Loans and Short Sales

How a Shreveport-Bossier Homebuyer Can Reduce Closing Costs

Going through the list of closing can be very overwhelming, especially if you are a first time homebuyer, but almost all of these fees and charges are negotiable and there are a few things that you can do to lower these costs.

1. Offer to Do Some of the Legwork in Exchange for a Rebate

Usually, buyers negotiate with their brokers to lower their fee, but aside from this, you may also offer to do some of the legwork, like checking property listings and going to open houses by yourself, in exchange for a rebate on their commission. The rebate is a percentage of the broker’s commission, which is given to the buyer at closing.

2. Do Your Own Research

If you want to be able to negotiate and get the best deal from your home purchase, you need to know all the fees and charges included in your closing costs and learn what they are for. This way, you can plan the best way to negotiate with the seller or your lender. With lenders, there is no standard way of listing closing costs. If you speak with two or more lenders, you will notice that they use different terms and some costs are bundled together. By taking the time to learn what these are, you can bargain to reduce some of these costs or take them out from the list if they seem to be vague.

3. Shop Around and Request Quotes from Several Different Lenders

Shopping around for lenders not only allows you to compare their rates, it also creates competition among them. Consequently, these lenders would offer even lower rates, so you end up getting a much better deal. According to a recent study, homebuyers are able to save as much as $1,500 by getting one more quote and at least $3,000 by getting quotes from five different lenders.

Although the list of closing costs may seem to be complex and confusing, having a real estate expert by your side would make it easier for a homebuyer like you to learn everything that you need in order to get the best deal from your real estate purchase. If you are in the market to purchase a house in the Shreveport-Bossier, LA area, I can help. Feel free to give me a call at (318) 294-6722 or send me an email at gregryan1211@gmail.com and I will get back to you the soonest possible time.